Credit: Is Marriage Important?

In this modern age of credit scoring, online banking and instantly verifying financial data, are some of the more traditional ways of assessing someone’s credit still relevant?

Asked About Marital Status when applying for Finance?

When you are applying for finance you might get asked about your marital status and find yourself wondering why lenders are asking this question.

Does being married mean that you have a better credit score and mean that you are more responsible with money?

Are you putting your partner at risk if you do not repay the loan?

Are there life events that can improve your credit score?

Why Do Lenders Ask About Marital Status when applying for Finance?

The general reason that specific questions are asked during the application process is so the lender gets to Know Your Customer (KYC) better, and make a decision based on their rate to risk calculation and the likely return on their money.

Lenders often favour married people and their eKYC processes are focused on and fine tuned to finding the best quality customers to lend to. To put it as simply as possible, lenders do not want customers failing to repay their loans

There have been several studies to to show that married people have better credit scores and more active credit files than single people. Married people are often homeowners, and therefore more secure in their residential status, so they are less likely to run from their debt. Married people are more likely to be employed and therefore have at least one regular salary coming into the house. Lending to a married person means that there are 2 people to repay the loan.

Married couples often need 2 cars, and they are more likely to have children, meaning repeat business for car financing companies when their family grows. Moving up from a cheap small car to a larger family saloon or “People Carrier” can mean that married couples are tied in to credit for up to 10 years. Then it is likely that the family will need newer cars, safer cars, and their vehicle will have to change with their family lifestyle.

Targeting Married couples has a lifelong return on the loan and the repeat business for the lender.

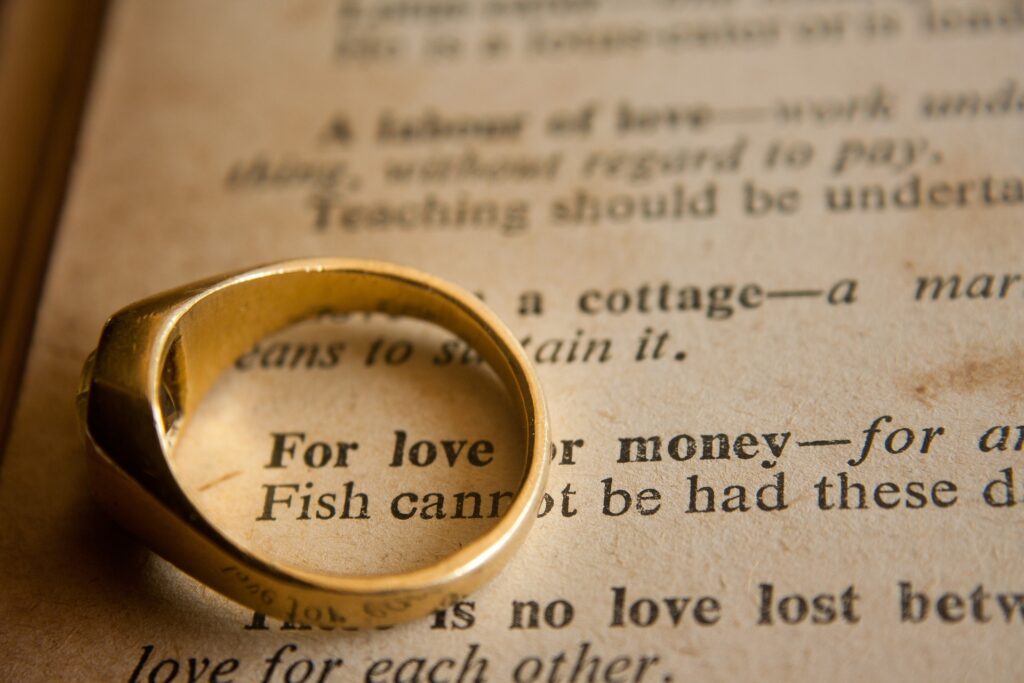

Is Marriage Important?

The answer from the perspective of a lender is a resounding YES. Think of the return on investment that married couples bring, compared to single people

Here at Match Me Car Finance , we don’t care if you are married, but we have to ask the question for our panel of trusted lenders. We value you, and respect your choices, we are here to provide the best possible finance for you, when you need it, so that you can get the car that you want.

When you are completing our application form, you might have concerns about why we are asking certain questions, you might worry that the answers are wrong, or what we will do with your data. If you have any questions at all, Contact us, we are here to help.

No Comments